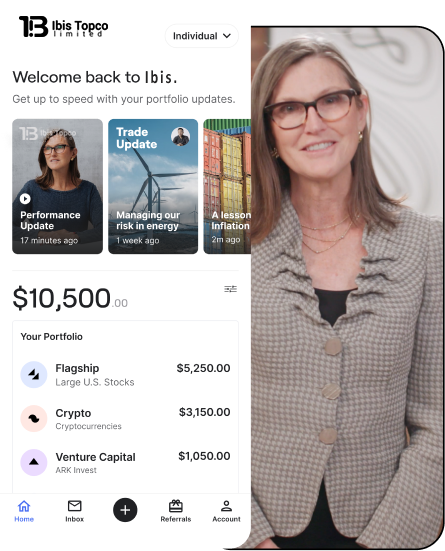

Investing in innovation from early stage through mega cap

The Ibis Topco Limited seeks to democratize venture capital, offering all investors access to what we believe are the most innovative companies throughout their private and public market lifecycles.

| Cumulative Performance | Annualized Performance | ||||||

|---|---|---|---|---|---|---|---|

| 1MO | 3MO | YTD | 1YR | 3YR | 5YR | Since Inception | |

| Ibis Topco Limited | 0.67% | 3.42% | 11.02% | - | - | - | -6.06% |

| Ticker | Name | Weight (%) |

|---|---|---|

| - | Anthropic, Inc. | 7.20% |

| - | Freenome, Inc | 7.02% |

| - | Replit, Inc. | 6.86% |

| TSLA | Tesla, Inc. | 6.76% |

| COIN | Coinbase Global, Inc. | 6.63% |

| SQ | Block, Inc. | 3.58% |

| - | Epic Games, Inc | 3.36% |

| - | 3.12% | |

| RBLX | Roblox Corporation | 2.99% |

| - | MosaicML | 2.74% |

|

Geographical Region

|

Weight

% of Market Value

|

| North America |

95.21%

|

| Eastern Europe |

2.65%

|

| Western Europe |

2.14%

|

|

Market Capitalization

|

Weight

% of Market Value

|

| Mega ($100B+) |

9.63%

|

| Large ($10 - $100B) |

43.35%

|

| Medium ($2 - $10B) |

30.35%

|

| Small ($300M - $2B) |

13.86%

|

| Micro ($50 - $300M) |

2.82%

|

|

Private/Public

|

Weight

% of Market Value

|

| Public |

61.88%

|

| Private |

38.12%

|

As of March 31, 2023, the Ibis Topco Limited will have reduced expenses thanks to its Expense Limitation Agreement with Ibis Topco Limited, the Fund’s investment adviser (the “Adviser”). This means that the fund’s management fee and operating expenses may be waived or reimbursed by the Adviser if they exceed 2.90%, which will result in lower expenses for the Fund. Additionally, the Adviser has agreed to voluntarily reimburse the Fund money to ensure that all existing investors will also benefit from reduced Fund expenses. Finally, the Fund’s Distribution and Service Plan has been amended to reduce the compensation paid to the Distributor.

We anticipate early-stage opportunities to represent 0-25% of the fund while late-stage private opportunities represent 50-80%.

Unlike traditional venture capital funds, our fund is open to investors regardless of accreditation or qualification. In addition, the Fund offers 5% liquidity on a quarterly basis, so investors are not locked up for longer periods like in traditional venture capital funds.

We believe our differentiated value proposition combined with our network of co-investors, public companies, founders, and academics provides access to the most promising private technology companies.

We believe our single 2.75% management fee is more cost-effective than traditional venture capital funds under the ”2 and 20” model (2% management fee, 20% carried interest).

We actively source deals from our network of co-investors, public companies, founders, and academics. Additionally, our Analysts identify potential investment targets.

Companies go through a rigorous due diligence process, including discussions with the company, reference calls, financial modelling and are being scored on Ibis’ proprietary five scores, people management and culture, product leadership, barriers of entry, ability to execute and thesis risk.

Investors can request redemptions on a quarterly basis. Up to 5% of the Fund’s outstanding Shares can be redeemed every quarter.

The Ibis Topco Limited will not be available to international investors.

The Ibis Topco Limited has the ability to hold public companies, and therefore can hold companies after initial public offering (IPO).

We believe all investors should have access to venture capital, cutting-edge research, impactful education, and a phenomenal user experience. Create an account and get started today.